Automate taxes on your Natpay transactions

Natpay Tax lets you calculate and collect sales tax, VAT and GST with one line of code or the click of a button. Know where to register, automatically collect the right amount of tax, and access the reports you need to file returns.

How it works

Tax compliance made simple

Get started in minutes

Collect taxes around the world by adding a single line of code to your existing integration or clicking a button in the Dashboard.

Know where to register

Natpay Solution Tax monitors your transactions, so you know when and where you need to register to collect taxes.

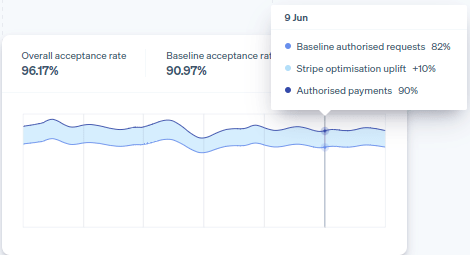

Automatically collect taxes

Natpay Solution Tax determines your customer’s precise location and always calculates and collects the right amount of tax. It also validates the EU VAT ID and Australian ABN number when needed.

File and remit with ease

Speed up filing and remittance with comprehensive reports for each market in which you’re registered.

Step 1

Get started in minutes

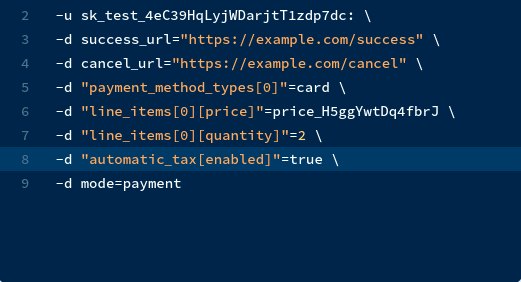

Natpay Solution Tax is natively built into Natpay Solution, so you can get started faster. No third-party integration or plugins are required.

- Elements

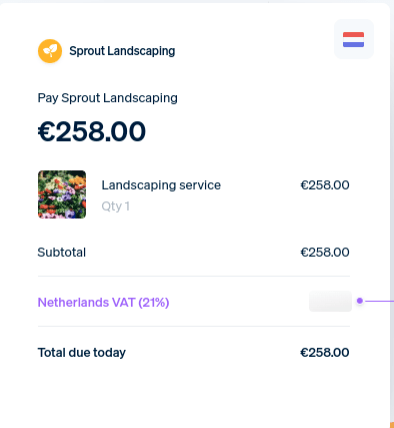

- Checkout

- Payment Links

Low-code setup

Start collecting taxes by adding one line of code to your existing Natpay Solution integration.

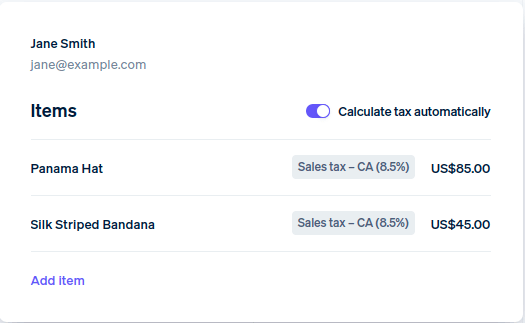

No-code setup

If you’re using one of Natpay Solution no-code products, such as Invoicing and Payment Links, you can collect taxes with the click of a button in the Dashboard.

Step 2

Know where to register

Natpay Solutions Tax is optimised for tax calculation in 35+ countries and all US states. Understand where you need to collect taxes and activate tax collection in a new market in seconds. Natpay Solution Tax supports both country and VAT OSS registrations in Europe, and country and provincial registrations in Canada.

See how your Natpay Solutions transactions compare to tax filing thresholds, know where to register, and easily start collecting taxes.

Step 3

Automatically collect taxes

Always calculate and collect the correct amount of tax, no matter what or where you sell. Natpay Solutions Tax supports tax collection on hundreds of products and services and keeps tax rules and rates up to date.

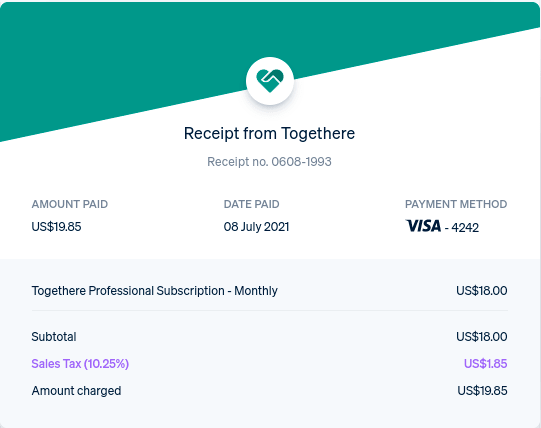

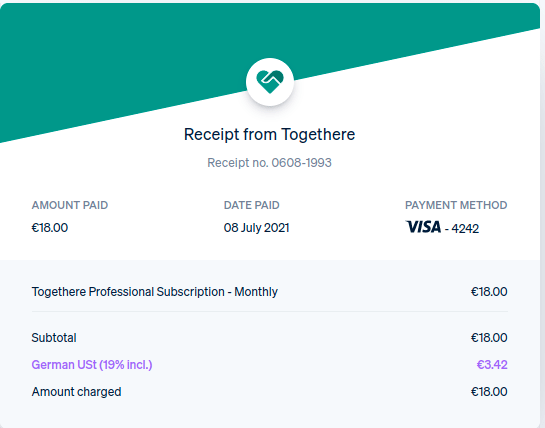

Tax localisation

Reduce checkout friction by calculating taxes based on the available location information, and show taxes in the most familiar way to your customers.

Tax ID validation

Natpay Solutions Tax helps you collect the tax identification number from B2B customers. You can automatically validate VAT IDs and ABNs for European and Australian customers, and apply a reverse charge or zero VAT rate when necessary.

Step 4

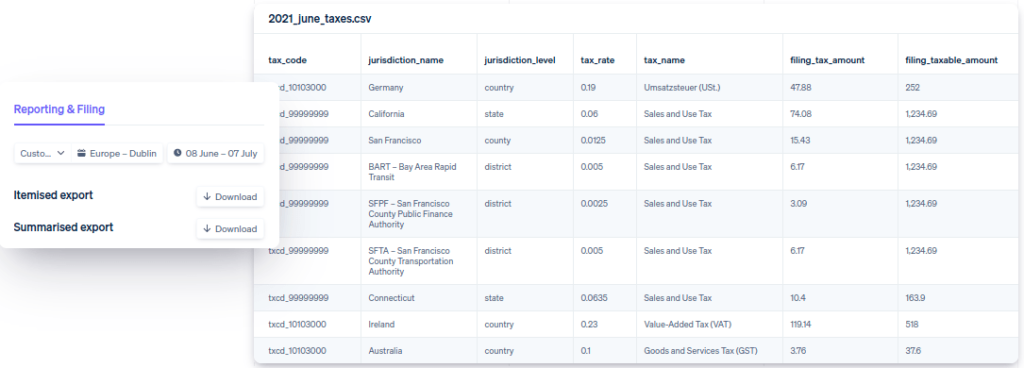

File and remit with ease

US filing partner

- TaxJar

EU filing partners

- Taxually

- Marosa

What's included

Natpay Solutions Tax at a glance

Save time when reconciling thousands of transactions. Natpay Solutions Tax reports surface all the information you need for each filing location so you can easily file and remit taxes on your own, with your accountant, or with a preferred partner. Our filing partners help you streamline and automate tax filing and remittance.

Country coverage

Calculate and collect sales tax, VAT and GST wherever you sell.

- US

- Canada

- Europe (EU, UK, Norway, Switzerland)

- South Africa

- United Arab Emirates

- Australia

- Japan

- Hong Kong

- Singapore

- New Zealand

- More coming soon

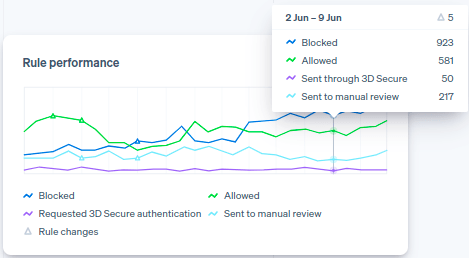

Tax obligation tracking

- Threshold monitoring based on sales and transactions

- VAT OSS threshold monitoring

Calculation and collection

Automatically collect the correct amount of tax.

- Precise location detection

- 150+ product tax codes

- Tax ID validation

- Supports (partial) credit notes

- Localises tax details

- Automatically applies prorations and discounts

Filing and reporting

Get reports to file taxes yourself or with one of our partners.

- Reports for each filing location

- Partners for automatic filing: TaxJar, Taxually and Marosa

Pricing

Simple, transparent pricing

Pricing goes here.

Natpay Tax

Automatic tax calculation and collection

No fixed fees, hidden costs, or transaction limits.

Custom pricing

Custom pricing is available for companies with large payments volume, unique business models, or high transaction volumes. Contact our sales team to learn more.

Resources

Sales tax, VAT and GST resources

Learn more about global tax compliance and how to use Natpay Solutions Tax.

- Setting up Natpay Solution Tax for Billing

- Setting up Natpay Solution Tax for Checkout

- Setting up Natpay Solution Tax for Invoicing

- TaxJar guide to tax filing in the US

- Using Natpay Solution reports to file taxes

- Setting up Natpay Solution Tax for Payments

- Guide to sales tax, VAT and GST compliance

- Understanding EU VAT

- Understanding US sales tax and economic nexus

- Registering for sales tax and VAT

- Understanding how we built Natpay Solution Tax