Use cases

Build better financial services for your customers

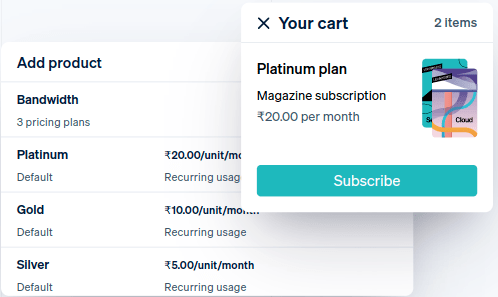

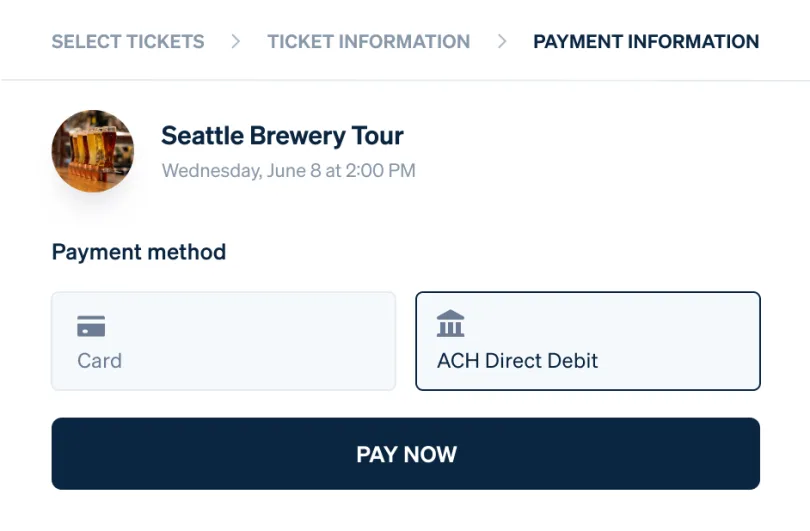

Let your customers accept online and in-person payments

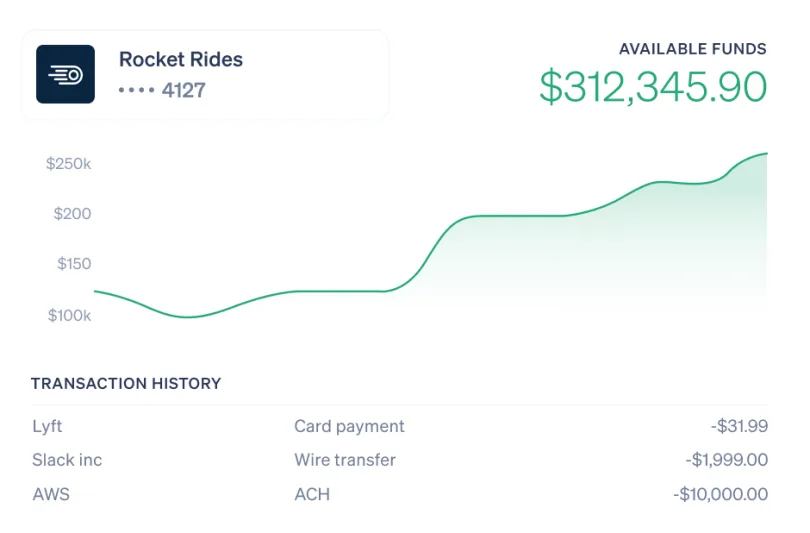

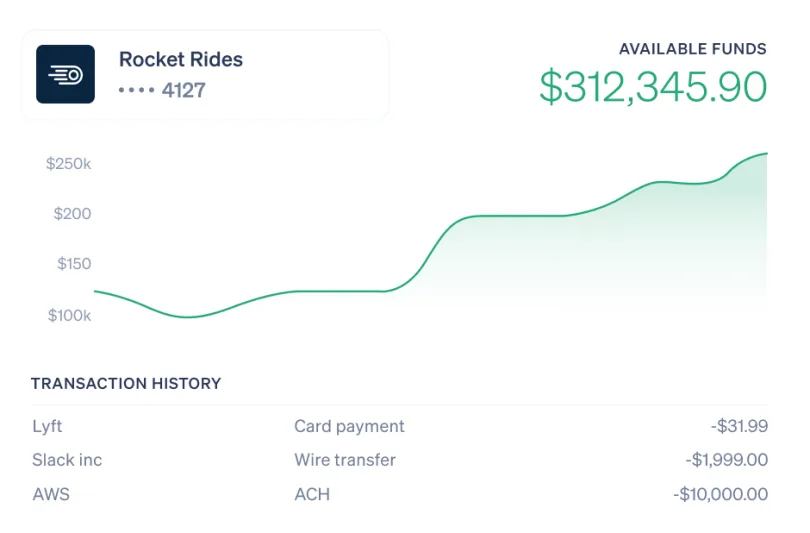

Allow your customers to store and spend funds

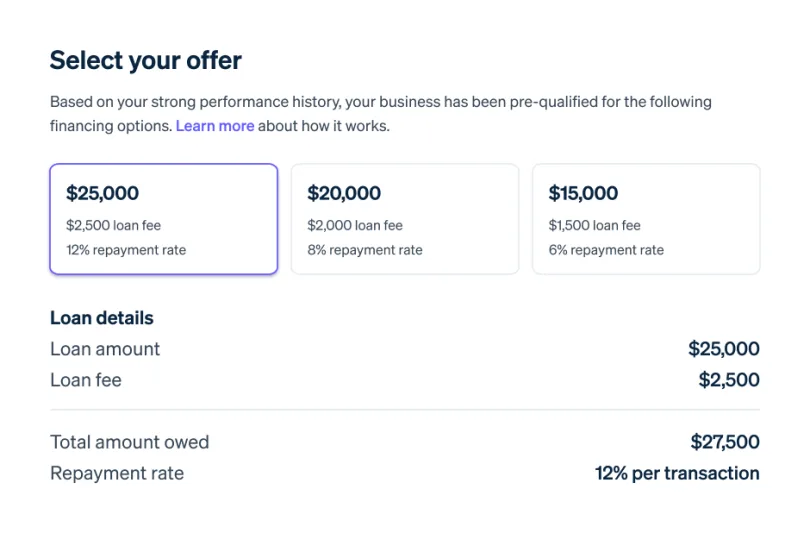

Provide businesses with access to capital

Issue cards for access to funds in seconds

Make financial products part of your offering

Build a one-stop destination

Enhance your software with financial services so that customers can manage all aspects of their business on your platform.

Win and retain more customers

Enhance your software with financial services so that customers can manage all aspects of their business on your platform.

Increase revenue

Enhance your software with financial services so that customers can manage all aspects of their business on your platform.

Learn more about banking-as-a-service

The fastest way for your platform to become a fintech

Natpay is the most streamlined way to build financial service offerings on your platform. We handle the fundamentals—such as back-end compliance requirements, bank partner negotiations, and infrastructure—so you can focus on creating tailored experiences for your customers.

A complete suite of financial products

Natpay enables you to build the services you need without integrating multiple technology partners—whether for payments, loans, financial accounts, cards, or all of the above.

Developer-friendly APIs

We provide intuitive APIs, docs, and integration processes so that you can get started without significant upfront—or ongoing—investment or resources.

Scale and reliability

Natpay enables payments for millions of businesses—including many of the world’s biggest platforms. The same reliable infrastructure powers our BaaS offerings.

Streamlined compliance

We make it easy for you to onboard and support customers while we handle complicated back-end compliance requirements.